Introduction – The EV Wave

ShrinkThatFootprint has overhauled its electric vehicle (EV) reviews and to commemorate a renewed focus on these wonderful pieces of technology. The inaugural review of the new format sees us present a review of a less common passenger vehicle, the Rolls Royce Spectre. In addition, we have organized all the reviews thus far into a neat table for readers to browse. But before you click away to read about this exciting car, what’s the big change that has lead to ShrinkThatFootprint putting more effort into reporting on EVs? Well, it comes down to recent US government funding and regulation changes.

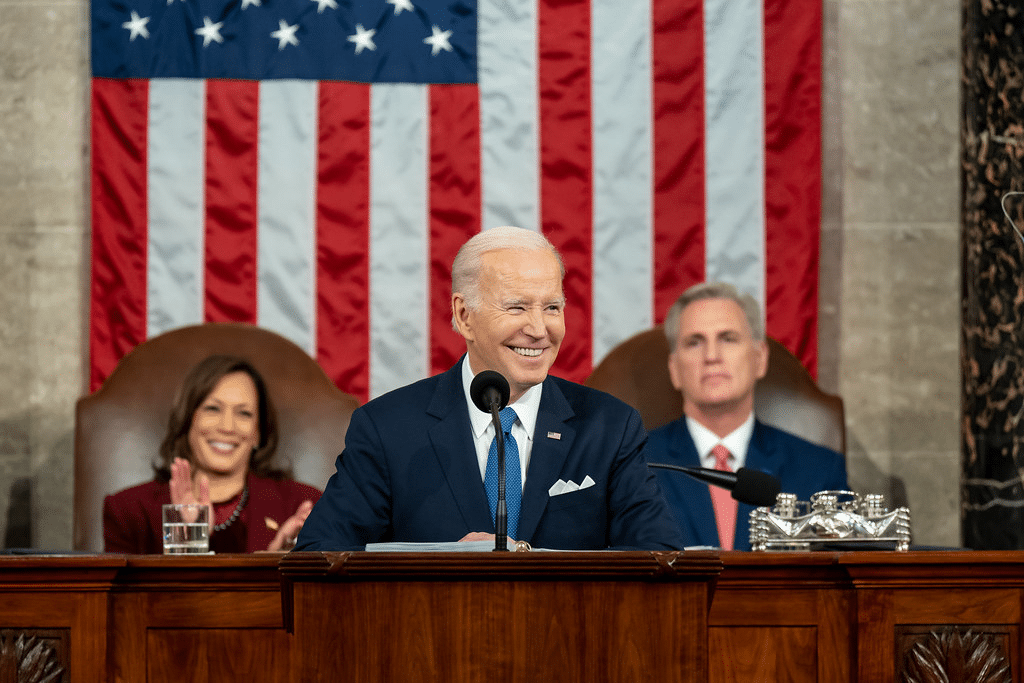

Inflation Reduction Act – $500 Billion In Spending

These are exciting times for electric vehicles (EVs). The Inflation Reduction Act, signed by President Joe Biden in late 2022, is an important piece of legislation that includes a reconfigured $7,500 tax credit for new electric vehicles and a new $4,000 tax credit for used EVs. This credit is designed to provide incentives to consumers and manufacturers to switch to electric vehicles, reducing emissions and helping to mitigate the effects of climate change.

In every way, investments in design, batteries, lithium and cobalt mining, and a projected share of new car sales at 7%, means that electric vehicles are poised to become a phenomenon of the decade.

New EV Tax Credit Has Been Overhauled

The EV Tax Credit has been restructured with new income limits, a cap on vehicle prices, and other requirements. It will provide incentives to car-based EVs costing up to $55,000, as well as electric trucks, vans, and SUVs up to $80,000. Additionally, the credit can only be used for vehicles with components and refining sourced from countries with which the US has a free trade agreement.

The EV Tax Credit extends and expands the existing $7,500 tax credit for EV purchases, and eliminates the 200,000-unit-per-manufacturer sales cap. This makes it a much more accessible incentive for consumers and makes it easier for manufacturers who have breached the 200,000-unit limit.

Sales Cap Elimination Will Stimulate Industry Leaders

The sales cap elimination will allow companies like Tesla Inc. and General Motors Co. to continue to benefit from the credit, while encouraging competition in the market by allowing other automakers to also benefit from the credit. The 200,000 limit had in the past meant that stalwarts of the EV industry like Telsa and GM could no longer benefit from the subsidies once they had sold above the number. The new legislation resets the limit.

The credit also includes a new North America final assembly requirement, meaning that only EVs with final assembly in North America are eligible for the credit, and US-made EVs must source their supplies of critical minerals from countries with which the US has a free trade agreement.

Credit Is Available To Those Below An Income Cap

The restructured credit also comes with new income limits and a cap on vehicle prices. Single filers earning $150,000 or less in adjusted gross income, head of household filers earning $225,000, and joint filers at the $300,000 level can claim the $7,500 credit, while car-based EVs must cost $55,000 or less, and electric trucks, vans, and SUVs must cost $80,000 or less.

The separate EV credit for used vehicles provides a $4,000 tax credit, or 30% of the vehicle cost, whichever is lower, and can only be applied to used vehicles costing $25,000 or less. This makes it an accessible incentive for consumers looking to purchase a used EV, while also encouraging more used EV sales in the next few years.

The income limits for the used vehicle credit are more stringent than those for new vehicle purchasers, with single filers earning $75,000 or less in adjusted gross income, head of household filers earning $112,500, and joint filers at the $150,000 level being eligible for the credit.

One unintended consequence may be that with the addition of subsidies it distorts incentives and manufacturers will account for it by raising prices above their margins.

Expected Impact: Price Reduction And Greater Access To EVs

With the EV Tax Credit in place, it is expected that the price of electric vehicles will drop and the availability of them will increase, allowing more consumers access to this cleaner form of transportation.

This wave of electric vehicles is also expected to have a positive environmental impact, reducing carbon emissions and helping to mitigate the effects of climate change. This will not only benefit the environment, but also public health, as electric vehicles produce fewer emissions than traditional gasoline-powered vehicles.

Expect A Positive Impact On Carbon Emissions

The EV Tax Credit is an important step in the right direction for the fight against climate change, providing incentives for both consumers and manufacturers to switch to electric vehicles.

This credit should result in an increased adoption of electric vehicles in the coming years, helping to reduce emissions and create a healthier, more sustainable environment for future generations. In general, ShrinkThatFootprint has held that EVs, being powered by the grid, will be as dirty as the power sources that make up the grid. And across a wide range of countries, the electric grid has lower carbon emissions than gasoline.

Criticism Of The Inflation Reduction Act

Critics of the Inflation Reduction Act have raised concerns about the domestic source requirements, which they argue will limit the availability and affordability of EVs. Some have argued that the income limits for the credits are too low, and that the caps on vehicle prices are too restrictive, preventing those who may be able to afford a more expensive EV from taking advantage of the credit.

Some have argued that the credits aren’t generous enough, and that more generous incentives are needed to encourage more widespread adoption of electric vehicles.

Finally, manufacturers outside the US have complained that the subsidies distort the market by shutting out foreign cars from benefiting from the subsidies. In the short term this is good for consumers, but in the long term by damaging the viability of foreign manufacturers, it could reduce quality and choice in the future.

Partisanship Dominated Political Discourse Around The Inflation Reduction Act

Passing the Inflation Reduction Act without a single Republican vote is a testament to the Democratic Party’s determination to enact legislation that they believe is in the best interest of the American people.

While many Republicans have expressed support for transitioning to more electric vehicles, they have expressed concern about the cost and other potential negative impacts of the Inflation Reduction Act. It will be interesting to see how Republicans respond to the passage of this legislation in the coming months and years.