The Impact of U.S. Coal Exports on Global Energy Supply

The United States stands as a significant player in the global coal market, with its vast coal reserves playing a crucial role in the international energy landscape. As countries around the world grapple with energy security and the transition to more sustainable sources, the question of how U.S. coal exports contribute to meeting global energy demands remains pertinent.

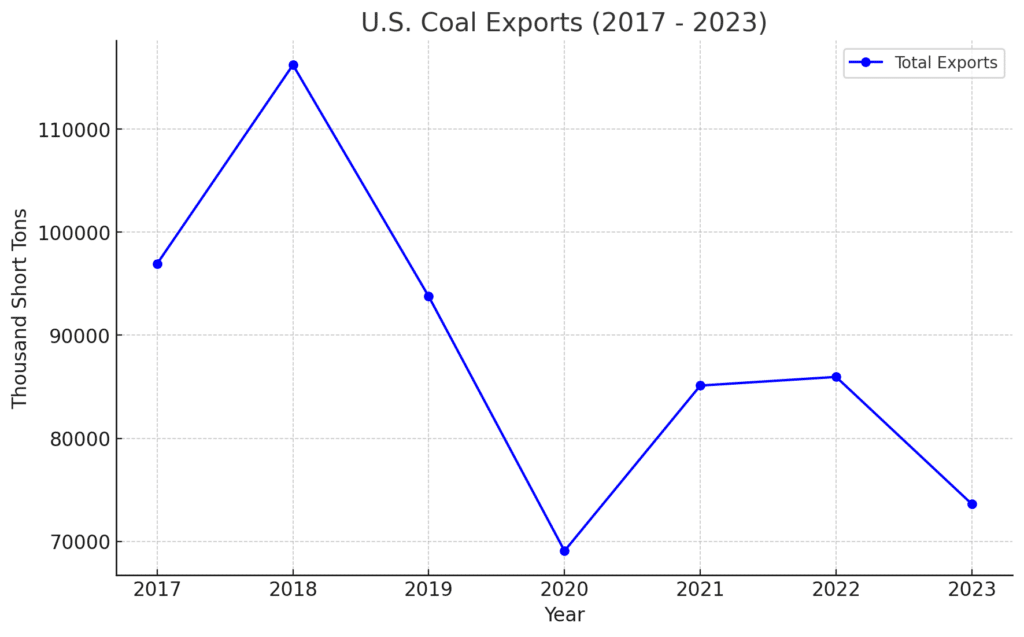

In 2018, the U.S. exported a remarkable amount of coal, exceeding 110 million tons, marking its stance not just as a domestic energy giant but as a key supplier in the global energy matrix. This analysis delves into the potential impact of these exports on electricity generation and how they could support household energy needs across different regions, specifically Europe and China, shedding light on the broader implications of coal trade dynamics.

The Significance of Coal in Global Energy Consumption

Coal has historically been a cornerstone of global energy consumption, offering a reliable and abundant source of power generation. Despite the growing push for renewable energy sources, coal remains integral in the energy mix of many countries, primarily due to its availability and cost-effectiveness.

This is especially true for regions with high energy demands but limited access to alternative energy resources. The export of coal from the U.S. plays a vital role in this context, supplying essential energy resources to countries that depend on coal for their electricity generation and industrial processes.

Analyzing the Impact of U.S. Coal Exports

To understand the impact of U.S. coal exports, we estimated the potential electricity generation from the coal exported in 2018 and assessed how many households could be supported by this energy in Europe and China. We used data from the EIA – see below for sources and methods.

The analysis was based on the conversion of coal quantities into kilowatt-hours (kWh) of electricity, considering average conversion rates and the efficiency of coal-fired power plants.

For Europe, with its smaller households and higher energy efficiency standards, the exported coal could theoretically support about 30.75% of its households. In contrast, in China, where the average household energy consumption is lower than in Europe but higher than in many other regions, the same coal exports could support approximately 38.66% of households.

Summary Of US Coal Exports

| Year | Total Exports (Million Tons) | Total Energy Produced (kWh) | Equivalent European Households Supported |

|---|---|---|---|

| 2017 | 97 | 238,484,700 | 59,621,175 |

| 2018 | 116 | 285,960,240 | 71,490,060 |

| 2019 | 94 | 230,661,900 | 57,665,475 |

| 2020 | 69 | 169,904,820 | 42,476,205 |

| 2021 | 85 | 209,382,900 | 52,345,725 |

| 2022 | 86 | 211,451,760 | 52,862,940 |

| 2023 | 74 | 181,083,060 | 45,270,765 |

Europe and China: A Comparative Perspective

Europe’s focus on energy efficiency and the transition to renewable sources has led to lower average household electricity consumption, estimated at about 4,000 kWh per year. In this light, the U.S. coal exports could significantly contribute to the energy needs of European households, supplementing their electricity supply.

On the other hand, China, with its rapid urbanization and industrial growth, has a higher demand for energy. The average Chinese household consumes about 1,750 kWh of electricity annually, making the potential contribution of U.S. coal exports even more significant, capable of supporting a substantial portion of Chinese households.

Decline In U.S. Coal Exports From 2018

The observed from the peak in 2018 to subsequent years can be attributed to several factors, reflecting broader trends in global energy markets, environmental policies, and economic shifts. Here are some key reasons for the drop in coal exports:

- Global Shift Towards Renewable Energy: There’s a growing global emphasis on reducing carbon emissions and combating climate change, leading many countries to invest in renewable energy sources like wind, solar, and hydroelectric power. This shift has reduced the demand for coal, a major source of CO2 emissions, in favor of cleaner energy sources.

- Environmental Regulations: Both in the U.S. and internationally, stricter environmental regulations have been put in place to limit emissions from coal-fired power plants. These regulations make coal a less attractive option for electricity generation, leading to a decrease in demand for coal imports.

- Competitiveness of Natural Gas: The surge in shale gas production, particularly in the U.S., has made natural gas a cheaper and cleaner alternative to coal for power generation. The availability and lower prices of natural gas have led to a significant shift from coal to natural gas in the energy mix of many countries, including those that were traditional importers of U.S. coal.

- Economic Slowdowns and Energy Efficiency: Economic slowdowns in key coal-importing countries can reduce the overall demand for energy, including coal. Additionally, improvements in energy efficiency and the adoption of energy-saving technologies reduce the overall demand for fossil fuels.

- Changes in Import Policies of Key Countries: Major coal-importing countries, including those in Europe and Asia, have adjusted their import policies and targets for reducing coal consumption as part of their climate change mitigation strategies. For example, China and India have both taken steps to increase their reliance on domestic coal production and renewable energy sources, potentially reducing their demand for imported coal.

- Coal Plant Retirements: The retirement of coal-fired power plants in various parts of the world, driven by age, inefficiency, or policy directives, has also contributed to the decreased demand for coal.

- Supply Chain and Logistical Challenges: Supply chain disruptions, such as those caused by the COVID-19 pandemic, and logistical challenges can also impact coal exports. Restrictions on shipping and trade can temporarily reduce the ability to export coal, though these effects might be more short-term compared to structural shifts in energy policy and demand.

Sourcing the Data

Data was sourced from the U.S. Energy Information Administration (EIA) Quarterly Coal Report. By analyzing this data, we aim to shed light on how these exports could potentially influence electricity generation and household energy support in Europe and China, offering insights into the broader implications of coal trade dynamics on global energy supplies.

The EIA’s Quarterly Coal Report serves as a comprehensive source of information, detailing the quantities of coal produced, consumed, and exported within and from the U.S. According to the report, the U.S. exported over 110 million tons of coal in 2018, a figure that underscores the country’s significant role in the global coal market. This analysis utilizes this data to estimate the potential electricity generation from the exported coal and assesses the impact on household energy consumption in Europe and China.

Conclusion – Coal Exports From USA

The analysis of U.S. coal exports in 2018 provides a glimpse into the potential of coal to support global energy needs. While the move towards cleaner energy sources is imperative for environmental sustainability, coal continues to be a critical component of the energy mix in many parts of the world.

The ability of U.S. coal exports to support a significant fraction of households in Europe and China highlights the interconnectedness of global energy markets and the ongoing relevance of coal in meeting worldwide electricity demands.

As countries navigate the challenges of energy security and sustainability, the role of coal exports in bridging the gap between current energy supplies and future energy needs remains a topic of considerable importance.