Introduction

Back in 2010 we moved out of London to a small town. In the process we had to change energy suppliers, so we took the chance to sign up to one of the many green energy tariffs on offer in the UK.

A week ago Sarah, a reader from North London, emailed asking if I could do:

an independent evaluation of just what you get for your money and how they compare to companies that still rely heavily on fossil fuels

So today I thought I’d give it a shot. In the process I hope I shed some light on how the leading green energy providers compare to the ‘Big 6′.

What Is Green Electricity Anyway?

Before I start hitting you with some data it is worth dispelling a misperception some people still have about green electricity supply.

In the England, Wales and Scotland we get our actual electricity from the National Grid. These electrons come from a mix of sources. In the last year that mix was coal (38.4%), natural gas (27.7%), nuclear (20.6%), renewables (11.3%) and other (2.0%). This resulted in average combustion emissions of 0.47 kg/kWh.

Renewables include solar, wind, and hydra. For a better understanding of the difference, take a look at our explanation of renewable vs non-renewable energy sources.

When you buy green electricity you are paying for a commitment by your supplier to put green electricity into the grid, in some proportion of what you use. This is done by procuring renewable energy from power plant owners or building their own capacity. Such infrastructure generation might be setting up wind turbines or partaking in solar farm construction.

To use truly ‘green’ electricity you would need to go off grid, and have some seriously great energy storage going on.

In the US the market is fragmented by state. In addition, because of deregulation, there are unusual options like paying variable or fixed rates for electricity.

Which Companies To Compare?

Three years ago when I looked at getting green electricity supply for our new place there was a huge array of green tariffs. Most of them were terrible, and far from green.

Two companies stood apart. Good Energy, because they only procured and sold renewables, and Ecotricity because they were doing a great job of building wind turbines with company earnings.

As I trawled through the data over the last couple of days, I was happy to see that both these companies have gone from strength to strength. In fact I think they both have more attractive offerings today.

Although there are some small companies doing interesting things with CHP and hydro, these two still seem far ahead to me. Given this, and in line with Sarah’s request, this post compares these two to the Big 6.

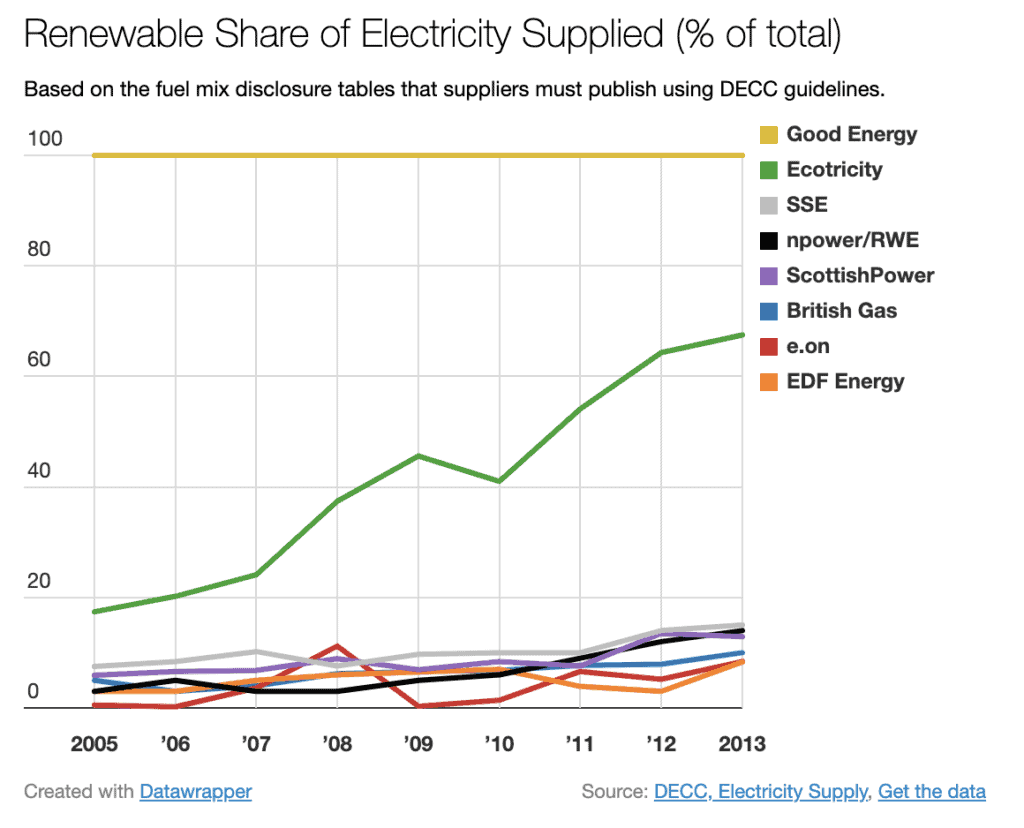

The Carbon Intensity Of Supply

Since 2005 all companies in the UK have been required to report their ‘Fuel Mix Disclosure Data Table’ for the year ending March 31. This means that there is public data that shows us what electricity each company buys, or produces, to be put into the National Grid.

From this data we know the carbon intensity of electricity supplied by each company. Which is a great place to start.

A few things are worth noting here.

Good Energy in yellow flat-line at the bottom, because they only buy renewable. Ecotricity in green have been gradually procuring more renewables over time. And the big orange crash in 2010 was the result of EDF acquiring 8 nuclear plants from British energy.

This chart gives a useful carbon comparison of the Big 6, Ecotricity and Good Energy.

Suppliers’ share of renewables

For many people the renewable share of supply is also of interest. It looks like this:

This is a pretty hard graph to misread.

Good Energy procures all its energy from renewables. Ecotricity have been building more and procuring more renewables over the years and on August 31st 2013 switched to a singular 100% renewable tariff.

The big six are indeed very big. So they can’t simply ramp up to 20% or 30% renewables overnight. That said, many people think they can do better than this. As you might expect, given the wind resources, Scottish Power, SSE and NPower are making progress.

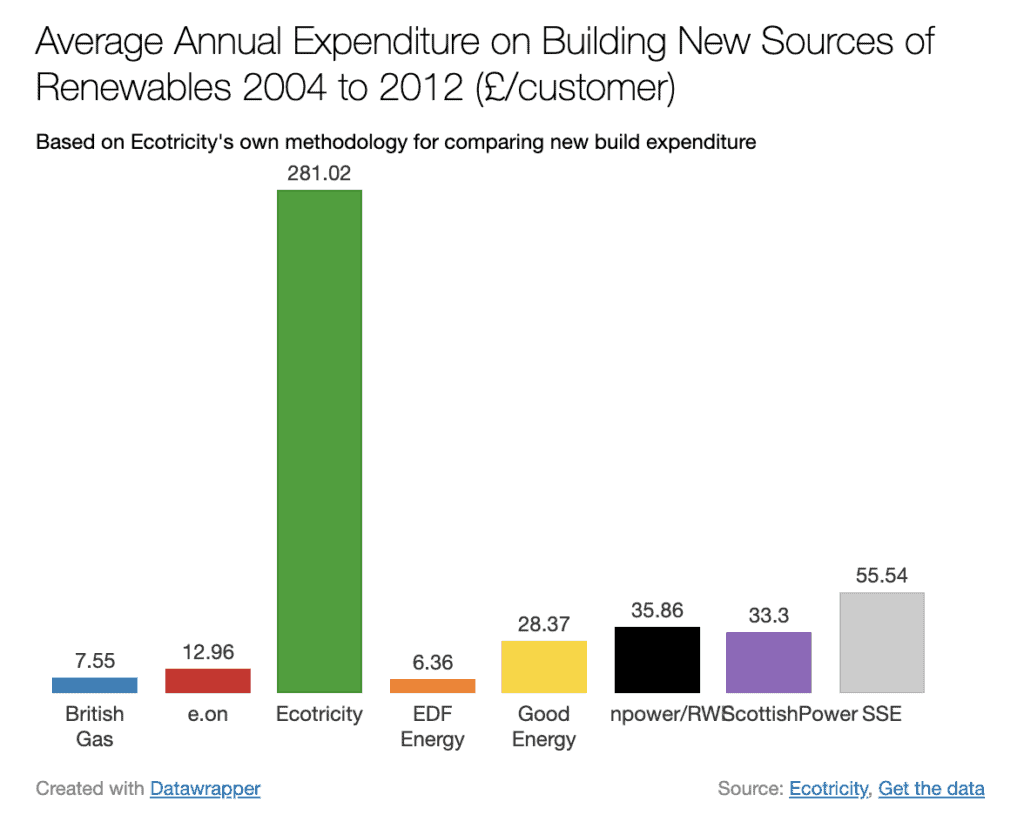

Who Is Actively Building Renewables?

Sadly, there isn’t much independently compiled data on which companies are building renewables in the UK that is freely available.

Ecotricity does a very good job of building their own wind farms given their size, so they have taken it upon themselves to compile an index of the average amount spent per customer on their rather curious Whichgreen.org website. The website is no longer useful though so I won’t provide a link.

Their data looks like this:

These figures from Ecotricity show that their spending per customer on new renewable capacity dwarfs all comers. In particular the figures from Good Energy seem relatively low, though this largely reflects the fact that they have a supplier based model whereas Ecotricity really are a generator at heart.

Sarah’s email asked me specifically what I thought of this comparison, so I’ll try to be honest.

I understand why Ecotricity feels the need to promote its strong record of ‘turning bills into mills’ in the face of numerous tariffs that are pure greenwash, but I fear with little context these numbers are incredibly confusing for most people, and potentially off-putting.

I worry that on first viewing people who aren’t statistically minded get the impression that Ecotricity is a giant of renewable deployment in the UK. In reality their 62 MW of wind capacity is less than 1% of the 10 GW installed in the UK, much of which is not owned by the Big 6, but rather by developers. Moreover the history of Ecotricity in installing turbines for 8 years before offering energy to domestic customers makes this framing feel more than a little cheeky.

Then again perhaps being cheeky is the point, and this is just the fickle economist in me kicking in? The statistic I prefer is that Ecotricity produced 38% of the electricity they supplied in 2012 from their own wind turbines. In contrast wind from all sources in the UK amounted to just 5.3% of generation.

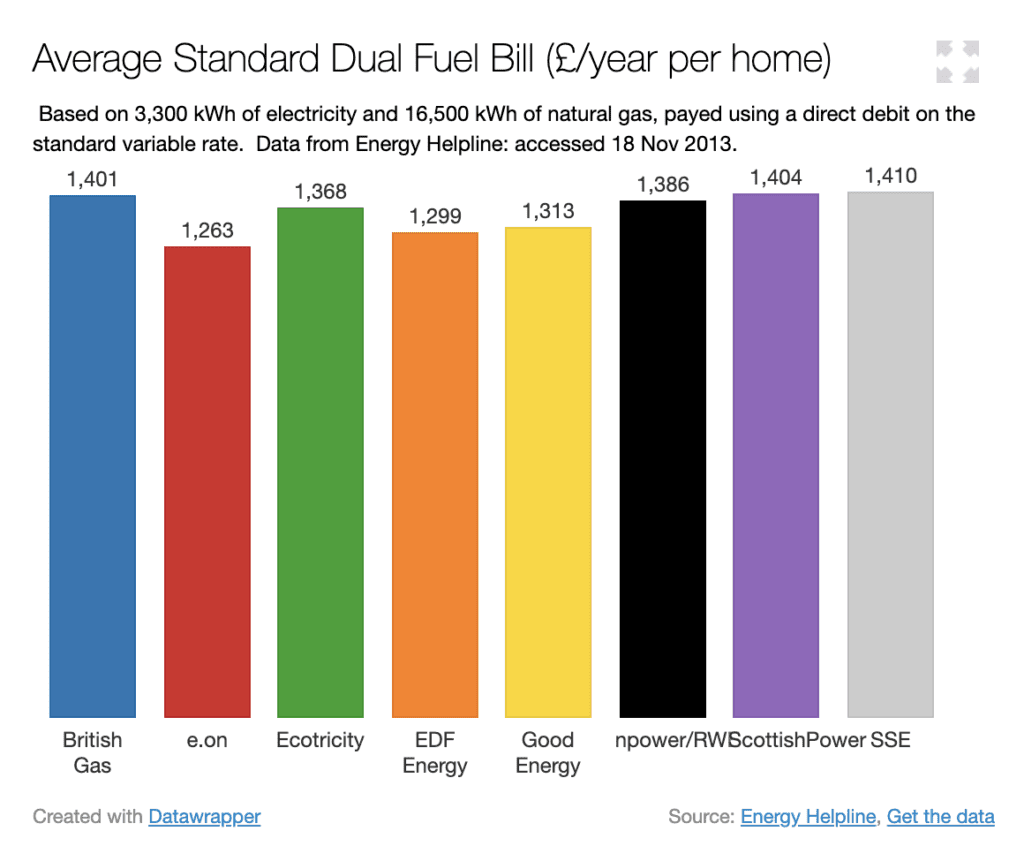

Comparing Prices

The standard price comparison used in the UK press for energy suppliers is the dual fuel bill for 3,300 kWh of electricity and 16,500 kWh of natural gas, paid using a direct debit. Dual fuel meaning that a house will use electricity as well as natural gas. Interestingly, modern portable generators come in models that are able to use dual fossil fuels like gasoline and propane combinations.

The following is a comparison of our eight suppliers based on these figures from the Energy Helpline. This was the best data I could find, but I can’t vouch for how objective it is.

I wouldn’t read too much into the precise differences between each of these suppliers, other than to say that neither Ecotricity or Good Energy is particularly expensive these days.

In fact on electricity alone Ecotricity are currently offering to undercut the in-region electricity price of five of the big six. I find this quite refreshing as when I looked into these tariffs previously the good green tariffs came at a significant premium. I’d imagine this is largely a reflection of the sharp rise in natural gas prices as we have turned to LNG imports from Qatar.

Customer Satisfaction

Our last category for comparison is customer satisfaction. For this I’ve grabbed the annual survey data from Which?, which complies an index based on customer ratings of value for money, customer service, billing, complaints and helping you save energy.

According to Which? both Good Energy and Ecotricity are miles ahead of the Big 6 for customer satisfaction.

Those aren’t the kind of gaps you get from sampling error. These two companies are clearly doing something that makes people like them more.

You can see the rating in full at ‘Which?’

Is Is Time To Switch To Green Electricity?

Choosing a green electricity supplier has always made sense from an environmental standpoint. The refreshing thing today is that you don’t need to pay a huge premium to switch to a good green supplier.

There remains an argument as to the relative effectiveness of different tariffs, and whether this is the most cost-effective way to cut carbon, but the principal is solid.

What’s To Like About Ecotricity?

There is a lot to like.

If Richard Branson and Elon Musk had a love child it could well be Dale Vince, the founder and CEO of Ecotricity. He’s one of those proper chance taking, shoot from the hip entrepreneurs, and I’d love to see what he could do with even more funds to play with.

Ecotricity operates a unique business which they call ‘bills into mills’. It is a not for dividend company that ploughs its earning back into building more wind turbines. This is not spin! (terrible pun I know). You can see on their company history page how their wind deployment has increased in lockstep with their customer numbers.

Since August 31st this year Ecotricity started offering a single electricity tariff that is 100% renewable. Although this may have largely been the result of new Ofgem regulations that saw bigger companies remove green tariffs, I think this is great news for Ecotricity.

The fact Ecotricity previously procured some coal, gas and nuclear was off-putting for some of their potential clients in the past, even if it was necessary to build more wind. That was the case for me. However with one simple 100% renewable tariff and a greatly timed price freeze promotion it is little wonder they have just signed up a record number of new customers.

Ecotricity also aren’t just about power supply. They are one of the leaders of installing electric car charging infrastructure and working on green gas, power storage and urbines. They’ve also raised two rounds of community ecobonds allowing ordinary people the chance to invest £20m in wind projects.

If building new renewable capacity is the main thing you want from your utility then you should check out Ecotrcity.

Why I Can Happily Recommend Good Energy

Good Energy has supplied 100% renewable electricity to the grid for a decade now, that makes them unique in the UK. This electricity is sourced from 550 independent renewable generators around the UK, for which the company has become a rowdy advocate.

We switched to Good Energy back in July 2010, when we moved out of London. I was quite torn at the time between Ecotricity’s build out record and Good Energy’s 100% certified renewable procurement. The thing that swayed me to Good Energy in the end was little to do with either of these.

I was intending to add solar panels to our new place and Good Energy had been running their HomeGen program since 2004. A friend had recommended them for this, and I also appreciated the host of energy-saving literature on their website. So Good Energy it was.

The reason I can happily recommend Good Energy is there really is nothing to report. We’ve had solar panels for two and a half years. Everything works and the Fit payments are smooth.

We are perpetually dis-organised in paying our bills, but even if you’ve been away and are close to the debt collector phase this is how your reminder goes:

Dear Mr Wilson,

Just a little reminder . . .

A couple of weeks ago we sent you a bill for £62.48 but we have yet received a payment. If you’ve sent it in the last couple of days, please accept our apologies for getting in touch and ignore this letter. If you’ve simply forgotten, don’t worry, just give us a call . .

I know things like this don’t matter much, but we were once with NPower and they cut off our gas for two weeks with no notice while my wife was 8 months pregnant. No apology. The contrast between the two is not lost on me. It’s the same on the phone, as if they have taken people from John Lewis and stuck them through finishing school.

Although Good Energy aren’t a developer at heart I am still keen to see them build more projects. They recently raised a £15m community bond which should allow them to develop a couple of wind and solar farms that already have planning permission. I’ll be pleasantly surprised if they make their stated aim of 110 MW by 2016, but it’s great that they have a bunch of projects on the go.

Based on my three years as a customer of Good Energy I can happily recommend them. You can check them out here .

(The Good Energy link is an affiliate link, my first in fact. I like their work and am happy to promote them).

Other Solutions To Green Energy

Lindsay Wilson

I founded Shrink That Footprint in November 2012, after a long period of research. For many years I have calculated, studied and worked with carbon footprints, and Shrink That Footprint is that interest come to life.

I have an Economics degree from UCL, have previously worked as an energy efficiency analyst at BNEF and continue to work as a strategy consultant at Maneas. I have consulted to numerous clients in energy and finance, as well as the World Economic Forum.

When I’m not crunching carbon footprints you’ll often find me helping my two year old son tend to the tomatoes, salad and peppers growing in our upcycled greenhouse.